Dollars and Decibels: The Barney Dawson Guide to Business Valuation

By Claudia Fontainebleau

I’ve interviewed my fair share of celebrities over the years, but none quite like Barney Dawson. At sixty, the frontman of legendary Aussie rock band “The Delinquent Accountants” still sports the same leather jacket he wore in ’85, though it’s considerably tighter around the middle these days. What makes Barney unique isn’t just his four-decade career in music – it’s his bizarre second life as a self-taught business valuation guru.

“Most people think rock stars can’t count past four – you know, to keep time,” Barney tells me, lounging in his home studio surrounded by platinum records and, oddly enough, financial textbooks. “But mate, when you’ve been ripped off by as many managers as I have, you learn to count every bloody cent.”

The Delinquent Accountants might seem an unlikely source of financial wisdom, but their journey from broke rockers to savvy business owners offers a masterclass in understanding business valuation – with a distinctly Australian flavor.

Scene 1: The Revelation

Barney’s sprawling Northern Beaches home is a testament to his success, though he insists it’s “just a shack with extra rooms for the grandkids.” As we settle into his studio, drummer Keith “Numbers” Thompson joins us, carrying a tray of green smoothies.

“Before we talk business, we hydrate,” Numbers explains solemnly. “Can’t value assets with a hangover anymore. Tried it in ’92. Accidentally sold our tour bus for a didgeridoo and a six-pack.”

Barney nods sagely. “Our financial awakening came after our third album went platinum. We were touring the world, selling out stadiums, and somehow still broke as church mice.”

“Remember that accountant?” Numbers interjects. “Bloke with the toupee that looked like a dead wombat?”

“Trevor!” Barney slaps his knee. “Told us we were worth millions on paper but couldn’t afford to fix the tour van. That’s when I realized there’s a difference between what people say you’re worth and what you can actually put in your pocket.”

This revelation led Barney down a rabbit hole of business valuation methods. He pulls out a dog-eared notebook filled with calculations and diagrams.

“See, valuing a business isn’t just about the cash flow, though that’s a big part of it,” he explains, suddenly serious. “It’s about understanding multiple approaches. Asset-based valuation looks at what you own minus what you owe – simple as. But for a band, our biggest assets were intangible.”

Numbers nods vigorously. “Our catalogue, our name, our image rights – can’t touch ’em, but they’re worth more than all our equipment combined.”

“The market approach is comparing yourself to similar businesses that have sold,” Barney continues. “Like when Midnight Oil sold their publishing rights – gave us a benchmark. But the income approach, that’s where the real money is. Calculating the present value of future cash flows.”

“In English, mate,” Numbers interjects, “it means what your business will earn tomorrow is worth something today.”

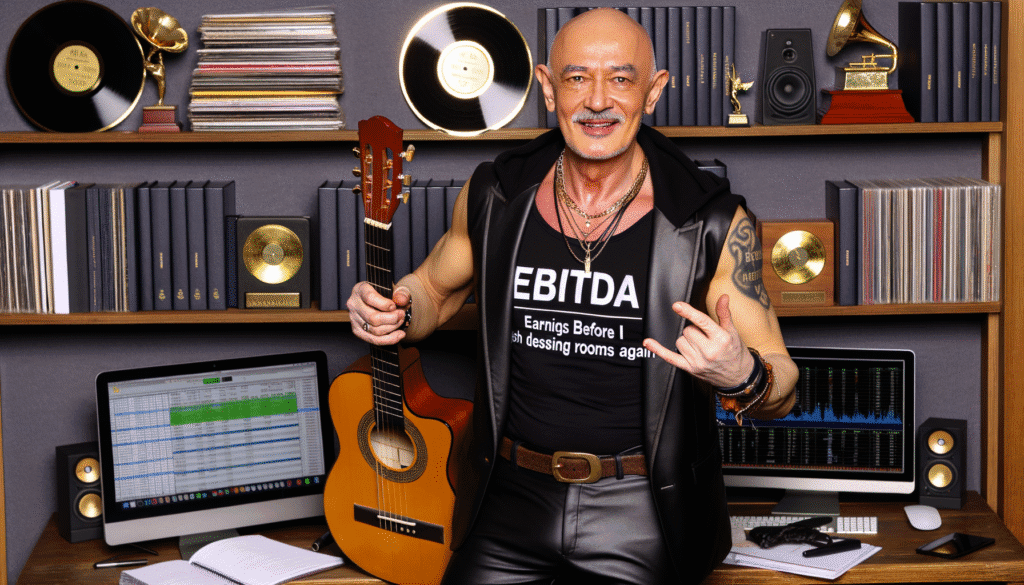

Barney grins. “Exactly. EBITDA – Earnings Before I Trash Dressing rooms Again, we call it.”

I can’t help but laugh. “I think the actual acronym is—”

“Earnings Before Interest, Taxes, Depreciation, and Amortization,” Barney finishes. “But my version’s more rock and roll, innit? The principle’s the same – understanding what your business generates before all the fancy accounting stuff.”

Scene 2: The Band Meeting

Later that afternoon, I’m invited to sit in on a band meeting in Barney’s backyard. The full lineup of The Delinquent Accountants has assembled around a massive outdoor table. Bassist Mick “The Multiplier” Johnson and lead guitarist Sarah “Tax Break” Williams complete the quartet. Despite their advancing years, there’s an undeniable energy as they discuss their upcoming tour and, surprisingly, their business valuation strategy.

“Right, you lot,” Barney begins, standing at the head of the table with an iPad. “The streaming numbers are up 22% since we released the remastered catalogue. That affects our discounted cash flow projections.”

Sarah rolls her eyes. “Here he goes again. Next, he’ll be banging on about our P/E ratio.”

“Actually,” Barney says, wagging a finger, “for private businesses like ours, the EV/EBITDA multiple is more relevant. Price-to-earnings is for you publicly traded types.”

Mick leans over to me. “Don’t let the financial jargon fool you. Ten years ago, Barney thought a balance sheet was something gymnasts used.”

“Heard that, Mick!” Barney shouts. “And for your information, I’ve always understood the importance of assets and liabilities. I just used to think liabilities were the groupies who wouldn’t leave after the show.”

The table erupts in laughter, and I’m struck by how this band of aging rockers has mastered a subject that intimidates most business owners.

“The mistake most bands make,” Numbers explains, passing around a plate of vegan sausage rolls, “is focusing on revenue instead of profit. We had our biggest tour in 2010 – sold out arenas across Australia. Made millions in ticket sales.”

“And spent millions on pyrotechnics and that ridiculous floating drum kit,” Sarah adds.

“Worth every penny,” Numbers defends. “But she’s right. High revenue, low profit. Terrible business model.”

Barney nods. “When we looked at valuing the band as a business, we had to be honest about our profit margins. A business valuation doesn’t care about how many fans scream your name or how tight your leather pants are – it cares about cold, hard cash flow.”

“Speak for yourself,” Mick interjects. “My leather pants definitely added value.”

“Only as a cautionary tale,” Sarah quips.

As the meeting progresses, they discuss various factors affecting their business valuation: intellectual property rights, brand recognition, market trends, and risk factors.

“Streaming changed everything,” Barney explains. “Had to completely recalculate our future earnings. Physical album sales were predictable – streaming is the Wild West.”

“Plus,” Mick adds, “we had to consider our age. Most valuation models assume continued performance. Hard to project that when your lead singer needs a hip replacement.”

“Oi!” Barney protests. “It’s just a bit of arthritis. I can still do the splits… horizontally, at least.”

Scene 3: The Legacy Plan

As evening falls, the conversation turns more reflective. The band members’ partners arrive, and the gathering takes on a family atmosphere. Barney’s wife of thirty years, Linda, brings out a cake celebrating the 40th anniversary of their first single.

“The most important part of business valuation,” Barney tells me quietly as we watch the others reminisce, “is understanding why you’re doing it. For us, it wasn’t about ego or bragging rights. It was about legacy planning.”

He explains that understanding their true business value allowed them to make informed decisions about the band’s future, their retirement, and providing for their families.

“We’ve seen too many musicians end up broke in their golden years,” he says. “Knowing what our business was worth meant we could make smart decisions about selling certain rights, retaining others, and diversifying our investments.”

Linda joins us, slipping her arm through Barney’s. “Tell her about the succession planning.”

Barney beams proudly. “My daughter Maya is a brilliant music producer. She’s gradually taking over the production company we started in the 2000s. But to hand over the reins properly, we needed to know exactly what we were giving her.”

“That’s where business valuation became personal,” Linda adds. “It wasn’t just numbers on a page – it was about family.”

As the night winds down, Barney walks me to my car. The aging rocker who once trashed hotel rooms and made headlines for his outrageous behavior now speaks passionately about discount rates and capitalization factors.

“You know what’s really rock and roll?” he asks, leaning against my car door. “Financial independence. The freedom to make music because you want to, not because you need the money to pay off your debts.”

He looks back at his home, where his bandmates and family continue celebrating. “Understanding business valuation gave us that freedom. Not very sexy, is it? Can’t exactly write a hit song about discounted cash flow methods.”

I laugh. “I don’t know, Barney. ‘Asset-Based Valuation Blues’ has a certain ring to it.”

“Don’t tempt me,” he winks. “I’ve written songs about weirder things. Remember our 1990 hit ‘Tax Deduction Woman’?”

As I drive away, I can’t help but reflect on the unlikely wisdom of Barney Dawson and The Delinquent Accountants. They’ve proven that understanding business valuation isn’t just for suits and spreadsheets – it’s for anyone who wants to protect what they’ve built and ensure their creative legacy lives on.

In Barney’s words: “Rock stars die, but properly valued intellectual property is forever.”

Claudia’s Stand-up Corner: I tried to value my own business once. Turns out, a collection of half-finished novels, seventeen coffee mugs, and the ability to make interview subjects uncomfortable with overly personal questions isn’t worth as much as you’d think. My accountant suggested I list my assets as “one laptop and diminishing prospects.” Talk about a write-down! But hey, at least I’m following Barney’s example – understanding my true value. Unfortunately, mine comes with a clearance sticker.

Note: This article is a part of an ongoing test of our Maxys Publishing System = a "humanity centric - Ai Enhanced Transformation" system currently in development.